“The human species, according to the best theory I can form of it, is composed of two distinct races, the men who borrow, and the men who lend.”

—Charles Lamb

When most people think about investing or growing their money, their thoughts turn automatically to the stock market. Money is dropped into the machine and a bet is placed that more money can be extracted later. That strategy may work out alright or, depending on timing, it may be disastrous. Speculating on the stock market is not, however, the only way to put money to work!

“Private lending” may or may not be a familiar term, but it is the oldest, most proven form of producing interest or income from assets. Private lending is simply lending money in exchange for interest (or occasionally, a share of profits).

There are many types of private lending. Some common examples would include lending capital to help a borrower:

- Purchase real estate which will then be developed, rehabbed, rented and/or refinanced.

- Start or expand a business venture, perhaps with a partner or fund.

- Refinance credit cards or other higher-interest debt.

- Fund personal projects—from kitchen remodels to weddings—perhaps through a “peer lending” platform.

Notice that, in each case, you are playing the role of the bank. Banks provide loans for mortgages, businesses and personal projects in exchange for interest. In private lending, you assume that role and gain the associated benefits—and risks. It’s a way of cutting out the middleman, which is the bank!

People and corporations seek funds from private lenders for many reasons. Sometimes, traditional bank financing is not available for a certain type of project. A person or company may not qualify for bank financing, yet may have adequate cash flow or income to repay the loan. And there are other advantages to private funds, such as privacy, speed, or the ability to scale a project.

Have you ever considered becoming a private lender? Perhaps you have loaned money to a friend or family member, either formally—with a contract—or informally—on a handshake. (Of course, there are advantages to NOT loaning money to friends and family!)

If you have money to lend, there are many opportunities, though all are not equal. Some strategies are flawed and risky. Done right, properly structured private lending can be a safe and powerful strategy for growing assets or generating steady income.

If you wish you had started earlier building your future retirement income, this is especially for you. Here are seven reasons you may want to “be the banker” and consider smart private lending opportunities!

Reason #1: Historically proven.

Lending has been a reliable way of generating profits and cash flow for centuries. We have records of private lending agreements as early as 3,000 B.C., showing people loaning to others for defined time periods in exchange for “interest” paid in wheat, livestock, shekels of silver, or other commodities. Interest rates of 20% – 40% were common in ancient times, though extraordinarily high rates became known as “usury” and were discouraged or outlawed.

Lending has been a reliable way of generating profits and cash flow for centuries. We have records of private lending agreements as early as 3,000 B.C., showing people loaning to others for defined time periods in exchange for “interest” paid in wheat, livestock, shekels of silver, or other commodities. Interest rates of 20% – 40% were common in ancient times, though extraordinarily high rates became known as “usury” and were discouraged or outlawed.

Of course, lending is a primary strategy of banks. Banks do not speculate in the stock market… they lend money!

In the Great Depression in the late 1920’s and 1930’s, the stock market crash gave investors a new reason to seek a different way to invest. At the time, the U.S. was just over 100 years old and had experienced several crashes and panics, as they were often called. However, the 22 years preceding the Wall Street crash of 1929 saw an impressive, if deceptive, bull run.

Investors such as John Powell soon learned that what goes up may go down… way down. After severe losses, Powell swore off the stock market, deciding that speculation was not for him. After all, Powell was a farmer by trade. He was used to planting crops and getting a fairly predictable result!

Powell began lending money to those who needed capital. He helped people purchase or temporarily finance properties. For the next three decades, Powell was a private lender with steady profits. He never invested in stocks again, yet he grew a tidy sum of money for his family.

Reason #2: Earn predictable income.

When you invest in the stock market, you are placing a bet that the price will go up. Of course, this is not always the case! Nobody thought that Enron would collapse or that the stock market would lose roughly half of its value in the DotCom bust and the Financial Crisis.

When you invest in the stock market, you are placing a bet that the price will go up. Of course, this is not always the case! Nobody thought that Enron would collapse or that the stock market would lose roughly half of its value in the DotCom bust and the Financial Crisis.

When you loan money as a private lender, you have a contract that specifies how much you’ll be paid and when. There is little guesswork. Properly constructed with protections, collateral and the right borrower, this delivers predictable returns. Interest is paid monthly, annually, or as otherwise specified in the agreement.

Is there risk? There is almost always risk when money leaves your pocket, although there are ways to effectively manage risk. A private lending deal should be properly vetted and constructed to guard against losses. For instance, collateral minimizes risks for private lenders and helps ensure timely payments. And as in all ventures, there should be complete transparency and no manipulation by government or corporations.

Reason #3: Receive excellent cash flow.

In addition to passing the test of time, the strategy of lending has created some of the most profitable businesses in the world. (Unfortunately, many people tend to be borrowers, not lenders!) Private lending gives you the ability to “be the bank” and get paid well.

In addition to passing the test of time, the strategy of lending has created some of the most profitable businesses in the world. (Unfortunately, many people tend to be borrowers, not lenders!) Private lending gives you the ability to “be the bank” and get paid well.

It is normally difficult to create meaningful gains or income with banking products, bonds or any financial instrument offering guarantees. However, properly constructed private lending offers an exception to this rule. Even in this low-interest environment, you can earn many times what your bank is paying… without the roller coaster ride of the stock market.

Should interest rates go up further, this is actually good for private lenders. Interest rates would naturally rise for private lenders as well as institutional lenders. There is always a demand for lending both inside and outside of mainstream channels. When it becomes more expensive for banks to lend and borrowers have a harder time accessing capital, demand for private lending increases.

Today, investors who want more income from their existing assets can earn a healthy return by becoming private lenders. And when the return is contractually agreed upon (as we recommend), you will know exactly what growth or cash flow to expect.

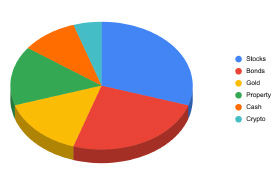

Reason #4: Diversify your investments.

Not only does private lending help diversify a stock-heavy portfolio; it can also help diversify different types of real estate investments. You may want to lend on different types of properties. You might want shorter-term and longer-term contracts. You can diversify by lending money in different locations and types of neighborhoods.

Not only does private lending help diversify a stock-heavy portfolio; it can also help diversify different types of real estate investments. You may want to lend on different types of properties. You might want shorter-term and longer-term contracts. You can diversify by lending money in different locations and types of neighborhoods.

Of course, it is handy to do business locally. But you might live in an area where it is difficult to earn a decent return. And even if your neighborhood is ideal, you never want to put all of your eggs in one basket!

Reason #5: Secure your cash with collateral.

If you are lending on real estate, your investment should be fully secured by the individual property itself. A first deed of trust is the gold standard, although there are different ways that private lending deals can be structured. (Be sure you’re not last in a long line to be paid!)

If you are lending on real estate, your investment should be fully secured by the individual property itself. A first deed of trust is the gold standard, although there are different ways that private lending deals can be structured. (Be sure you’re not last in a long line to be paid!)

You’ll want to verify that you maintain a good loan-to-value ratio—hopefully a good deal more—than the amount you are lending. The lower the loan-to-value percentage, the more security you have for your investment.

Of course, not all private lending opportunities are secured by a real asset. In the case of peer lending, the borrower’s income and good credit are your “security.” Credit scores, income and other factors can be helpful predictors of risk, especially alongside collateral.

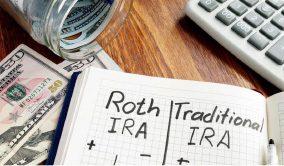

Reason #6: Use a self-directed IRA to defer taxes.

One advantage of a properly structured private lending agreement is that it can be done inside of a self-directed IRA. With an IRA, you get the benefit of a tax deferral. Gains are deferred until withdrawn from the IRA (typically in retirement).

One advantage of a properly structured private lending agreement is that it can be done inside of a self-directed IRA. With an IRA, you get the benefit of a tax deferral. Gains are deferred until withdrawn from the IRA (typically in retirement).

If new money is placed in an IRA, you will receive a tax benefit in the form of a deferral. IRA contributions are deducted from your current taxable income and become taxable upon withdrawal from the IRA.

Private lending can also be done outside of an IRA environment; it is your choice.

Reason #7: Maintain Roth conversion flexibility.

With a properly constructed private lending deal, you can convert all or a portion into a Roth IRA to avoid paying taxes on future gains or interest income. You’ll have the flexibility to do so a bit at a time, which can help you avoid higher tax brackets.

With a properly constructed private lending deal, you can convert all or a portion into a Roth IRA to avoid paying taxes on future gains or interest income. You’ll have the flexibility to do so a bit at a time, which can help you avoid higher tax brackets.

The beauty of this strategy is that you can gradually move your nest egg into an environment where future income and gains will never be taxed. (Never!) This is our favorite strategy to create passive, tax-free income in retirement (or whenever you want it!)

What’s the catch!?

You’ve no doubt heard the term, “buyer beware!” The same could be said about lenders. If you have cash, private lending deals may be plentiful. However, some are better than others. Some aren’t “deals” at all–especially not for novice private lenders!

You’ve no doubt heard the term, “buyer beware!” The same could be said about lenders. If you have cash, private lending deals may be plentiful. However, some are better than others. Some aren’t “deals” at all–especially not for novice private lenders!

With private lending, you assume the risks as well as the benefits of lending. That is why we have carefully vetted what we believe is the BEST private lending opportunity. We work with property developers and real estate companies with a long track record of paying private lenders like clockwork. All capital is fully collateralized and the investment qualifies as an exempt security, which gives private lenders additional protections. Interest rates are competitive and vary according to the length of time. It is not necessary to be an accredited investor (although you can be!)

To learn more about this private lending opportunity to create profits and cash flow, reach out to us today.

We’ll send you a short video that illustrates how private lending has helped our clients grow both their assets and income. No pressure… we’ll just give you the information you need to make an informed decision, then get your questions answered!